The Federal Reserve raised rates 11 times total between 2022-2023, and the first rate cut has been long anticipated as we’ve waited to see inflation numbers come down in-line with the data they need to support such a move. That time has finally come. Now that the Fed has begun its easing cycle, many people are looking forward to feeling some relief in interest payments as a result of future anticipated cuts. With the expensive cost of debt being a burden to homebuyers, clients often ask if they should wait to make a move until after the Fed acts. While the Feds rate decisions do have a ripple effect in credit markets, it isn’t that simple when thinking about the relationship to mortgage rates.

Fed Funds Rate vs 10-Year Treasury Yield

When the Fed talks about cutting or raising interest rates, they are specifically referencing the federal funds rate, which is a short-term rate used by banks who lend to each other over night. The 30-year fixed rate mortgage, however, tracks the 10-year Treasury yield because both are long-term instruments. Therefore, mortgage lenders use Treasury yields as benchmarks in pricing.

Although the 30-year mortgage rate tracks a different benchmark, both rates do tend to trend downward over time together. Mortgage rates have already started softening based on other economic data, and according to history, you should continue to see them trend downward after the Fed cuts rates. This tends to happen because people are buying into the ten-year treasury at the same time, and this can be a sign of a slowing economy. This, of course, is what the Fed wants. If the expectation is for inflation to remain low, the demand for more stable investments like bonds increases and result in lower yields.

Effect on home equity lines of credit

Unlike long-term fixed rate mortgages that track the ten-year treasury, home equity lines of credit follow the fed funds rate directly. Therefore, you can expect to see immediate rate decreases in-line with the amount the fed cuts the fed funds rate.

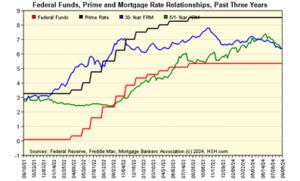

As you can see in the graph above, the Federal funds rate and Prime rate are very closely related, as the Prime rate is based off the Fed funds rate. Similarly, the chart below shows just how much in line the 10-year treasury and 30-year mortgage rates are.

Source: 10-Year: FRED, 30-Year Mortgage Rate: FRED

This last chart says it all; the general trajectory of mortgage rates and the Fed funds rate align over time, but interim periods show the two can certainly diverge.

Sources: Fed Funds Rate: FRED, 30-Year Mortgage Rate:

FRED https://americandeposits.com/relationship-between-mortgage-rates-fed-funds-rate/

As the Fed cuts, those with balances on HELOC should see an immediate reprieve, and the trend does appear to be in your favor. On the other hand, for new home buyers, it is a little more challenging. As the Fed cuts, you may feel the desire to refinance and take advantage of lower rates, but between closing costs on refinancing and the way an amortized mortgage works, you may have to wait for a few cuts before it makes sense.

While the Federal Reserve does not directly set mortgage rates, we can see how it can indirectly affect them in the broader market. Clients shouldn’t feel the need to time their mortgage, however, based on the Feds meetings. It is more important to focus on the overall trend and future economic outlook to gauge where rates might be going, to understand the impact when the opportunity is right for you.

Kristina Mello, MBA serves as Senior Advisor and Director of Financial Planning at StrategicPoint Investment Advisors in Providence and East Greenwich. You can e-mail her at kmello@strategicpoint.com.

The information contained in this post is not intended as investment, tax or legal advice. StrategicPoint Investment Advisors assumes no responsibility for any action or inaction resulting from the contents herein. Kristina’s opinions and comments expressed on this site are her own and may not accurately reflect those of the firm or our parent company, Focus Financial Partners. Third party content does not reflect the view of the firm and is not reviewed for completeness or accuracy. It is provided for ease of reference.

Certain statements contained herein may be statements of future expectations and other forward-looking statements that are based on SPIA’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. In addition to statements which are forward-looking by reason of context, the words “may, will, should, expects, plans, intends, anticipates, believes, estimates, predicts, potential, or continue” and similar expressions identify forward-looking statements. Forward-looking statements necessarily involve risks and uncertainties, and undue reliance should not be placed on them. There can be no assurance that forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. SPIA assumes no obligation to update any forward-looking information contained herein.