Monday’s market meltdown was blamed on Evergrande, a real estate development company in China. Real estate growth in China has long been a hot button issue for investors. It’s been EIGHT YEARS since we saw 60 minutes do a piece on the empty Chinese cities (apologies for the Australian version, we can’t seem to find video of the American version of the same story).

The real estate industry in China is a massive part of their economy. If you count upstream and downstream impact, estimates are that it accounts for 30% of their GDP. As with many things related to China (and even more so with Evergrande), it’s hard to know the “real” figures. Here in the US, that figure is in the low teens. Even when housing was on fire in 2007, it never contributed that much to our GDP.

It’s important to remember that China wants to pivot their economy towards a more consumption-based economy (mirroring our own economy here in the US). They want to stop relying on exports and manufacturing for a myriad of reasons. The Chinese government has been trying to reel in the excesses in the real estate market for years. They know that the real estate industry is sucking up a tremendous amount of capital that in their mind would be better served in other sectors of the economy.

Of more concern to the Chinese government is the fact that real estate developers in China use a tremendous amount of leverage. As with anything, the more you borrow, the less of an economic shock is needed to bankrupt a company (or a household for that matter). To combat the massive growth in debt issued by their real estate developers, they announced the “Three Red Lines” policy. Each line was essentially a leverage ratio, that if the developer crossed, limits their ability to issue new debt. These policies were really aimed at controlling the growth in home prices, rationing credit available to the real estate sector, and making sure the developers themselves (many of which are considered too big to fail) were stronger from a business perspective.

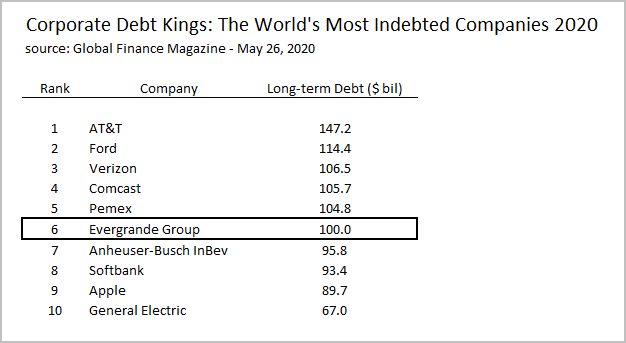

Evergrande failed the “three red lines” test, meaning they have too much debt and couldn’t issue more. Without going into the intricacies of how land is developed in China, just know for Evergrande this was the equivalent of staving a fire of oxygen. Evergrande is the SIXTH LARGEST DEBT ISSUER IN THE WORLD, they need to be able to issue more debt to survive.

So why are they an issue now?

They were not the only major developer to fail the new policies. However, after a few months many of their competitors started to show improvement, while Evergrande showed very little improvement against the three metrics. Fast forward to this summer, and two major Chinese banks said “We’re not lending to people who want to buy a home from Evergrande” which cut off even more oxygen to the company.

The reason for the market shock this week is that Evergrande has a debt repayment coming up. In years past, they would just roll this debt (like homeowners do when they refinance) into the future. But since the Government has cut off their ability to issue new debt, they are in trouble. The market knows they owe a huge debt repayment to their existing bond holders and it appears they won’t be able to pay.

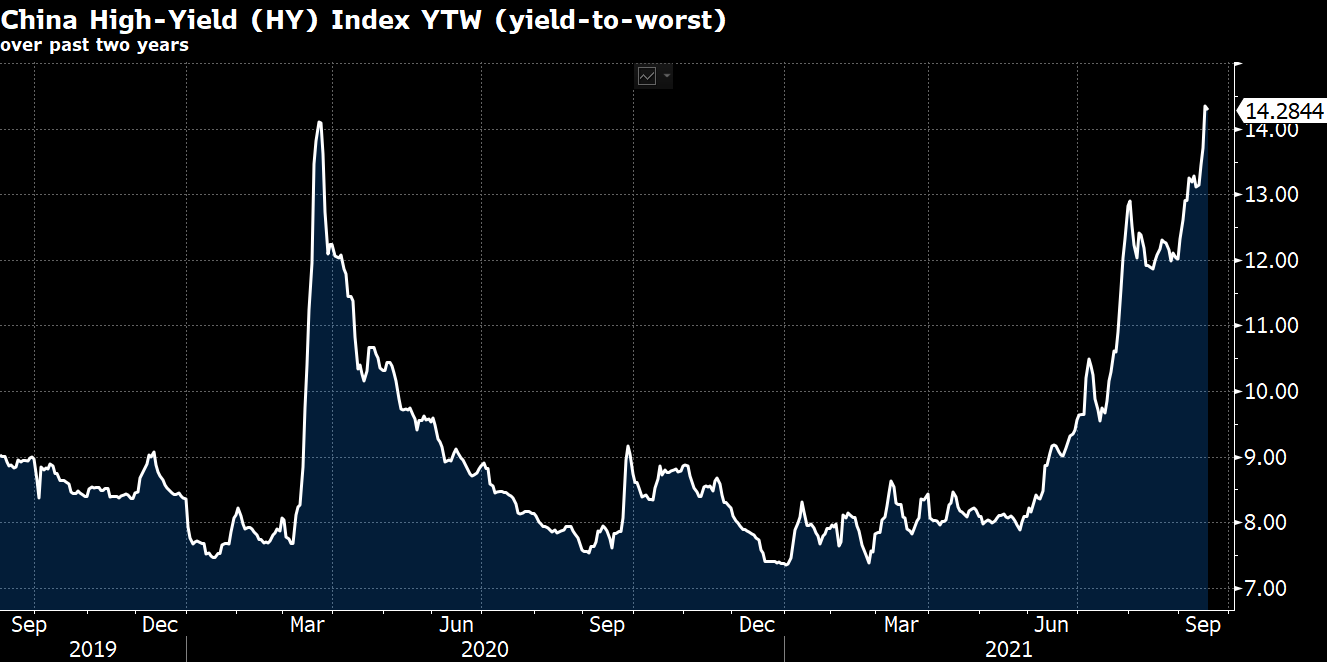

This issue (of not being able to repay) has now morphed into fears of contagion. As the old saying goes “no one ever finds just ONE cockroach.” While the US high Yield bond market currently sits at record low yields…the Chinese HY market has spiked to over 14%:

It remains to be seen if investors around the globe are off the mark, with the fears of there being more developers in trouble. As it has been for a while, transparency is an issue when dealing with Chinese companies. So right now, the market is treating it as everyone is guilty, and you have to prove you’re innocent.

What will the Chinese government response be?

Most of the banks in China are SOE (state owned enterprises). It’s going to be hard to let Evergrande fail and not see their banks impacted. At the same time, with the “Three Red Lines” initiative, it does appear as though the government wants to make a statement that Evergrande should have cleaned up their business. The fact that many other developers started to improve against the metrics, and Evergrande did not, put a bullseye on Evergrande’s chest. As of now most analysts feel that the Chinese government will make an example out of Evergrande, but not put their entire economic system at risk.

Other Reasons for The Market Correction

I don’t believe Evergrande is the sole reason for this correction. We haven’t seen any market correction, or really even any volatility, since before the 2020 Presidential election. Everyone has been saying “we were overdue” for a market correction.

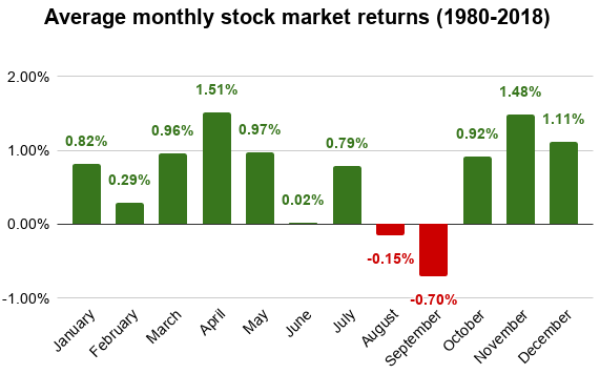

September has historically been the single worst month for stocks, and this year seems to be no exception. This chart is a little old, but you can see over a 38-year time frame what the average stock market returns have been by month, and clearly September is the worst performer:

We also have the Fed meeting later this week, with tapering talk sure to be at the forefront. Expectations are NOT that tapering begins this week, but rather that the time frame for when it will begin will be announced. We’ve recently seen the bond market react as if the tapering announcement is going to come, because we’ve seen the yield curve start to flatten. Besides tapering expectations, a flattening yield curve is also a sign that the bond market thinks growth is stalling.

To summarize, when you add up the seasonality of a weak month of September for stocks traditionally, a Federal Reserve potentially ready to announce the first step to reeling in some of the monetary stimulus, and the potential for a major bond issuer (Evergrande) missing a bond payment it’s no wonder that the US stock market has started to sag. Ultimately this too shall pass, but after 11 months without any real down swings in the market, we should probably prepare ourselves for volatility to reappear.

Derek Amey serves as Partner and Portfolio Manager at StrategicPoint Investment Advisors in Providence and East Greenwich. You can e-mail him at damey@strategicpoint.com.

The information contained in this post is not intended as investment, tax or legal advice. StrategicPoint Investment Advisors assumes no responsibility for any action or inaction resulting from the contents herein. Derek’s opinions and comments expressed on this site are his own and may not accurately reflect those of the firm. Third party content does not reflect the view of the firm and is not reviewed for completeness or accuracy. It is provided for ease of reference. Certain statements contained herein may be statements of future expectations and other forward-looking statements that are based on SPIA’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. In addition to statements which are forward-looking by reason of context, the words “may, will, should, expects, plans, intends, anticipates, believes, estimates, predicts, potential, or continue” and similar expressions identify forward-looking statements. Forward-looking statements necessarily involve risks and uncertainties, and undue reliance should not be placed on them. There can be no assurance that forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. SPIA assumes no obligation to update any forward-looking information contained herein.