For the vast majority of 2022 we believe the markets will be waiting and responding to everything the Fed does and everything the Fed says. The working assumption has been that we will see 3-4 rate hikes in 2022. To a certain extent that is already priced into the stock and bond market. As a sidebar, we do not think these rate hikes will have an extremely large impact on the economy in 2022. Studies have shown that it takes time for the Fed moves to work their way into the general economy.

Markets are forward looking, and since many believe the Fed is already behind the curve, changes in the pace (or even number of hikes in 2022) will be market moving news. If we compare the economy to a car on Route 95, it’s currently doing 85 mph. The current Fed policy is at “emergency” levels, and for a car doing 85 mph in a 65-mph zone, that sort of policy is no longer needed or wise. The issue is how to apply the brakes. If they stomp on the brakes too hard, they could see the general economy really start to slow down AND the markets revolt and selloff hard, which would create a negative feedback loop whereby consumers start to grow concerned and start to pull back on spending. If the Fed doesn’t apply enough pressure on the brakes, then Wall St could start to grow concerned that they are falling even farther behind the curve, which would lead to fears of potential policy errors in the future. The Fed really is trying to thread the needle, by slowing the economy enough to curb inflation but not too much to shake consumer confidence and create a recession.

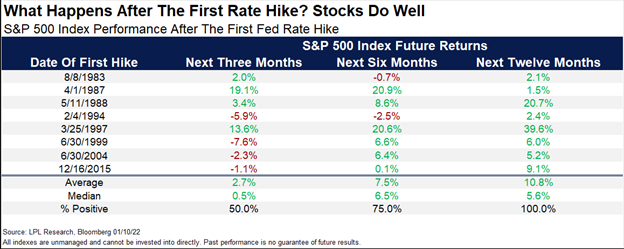

The first rate hike will most likely be in March. Historically, the first hike has not been a bad omen for stocks. As you can see in the chart below, while the first 3 months after that hike has been challenging (with 4 of last 8 times stocks were negative 3 months after the first hike) the 6-month and 12-month returns look much stronger.

When one starts to think about why we see results like those shown in the chart, it does start to feel like 2022.

In the short term after the first Fed move there is all this attention and fear that the Fed is going to screw up and derail economic growth. I think some of the fear is embedded in the psyche of investors from the Volker-era, when to crush rampant inflation, he was forced to push the US economy into a recession.

Historically (and we see this today), the Fed begins to raise rates in the middle of the business cycle because the economy is growing too quickly and inflation is bubbling up. We believe the chart above shows as time passes, investors realize that the Fed hasn’t moved to fast and too far to threaten the economy and earnings, so the market starts to acclimate itself to higher rates.

Essentially, we think the chart shows that in the 3 month returns, the market worries about a worst-case scenario occurring (a Fed policy error-induced recession). When those fears prove to be false, the economy continues to grow (even if at a slower pace) and earnings continue to grow, stock prices respond positively. This could be the road map for 2022.

That doesn’t mean it will be a smooth year for the stock market, and certainly the first two weeks have confirmed these concerns. As we thought about 2022, for the first part of the year we did expect volatility to return to the stock market. In the last 40 years, on average the S&P usually experiences a 14% market correction every calendar year. Last year was abnormal in that the largest correction we saw was just shy of 6%, so we were overdue in that regard. Couple that fact with the expected first hikes, and the probability of a double-digit correction seems to be growing in the coming weeks/months.

But back to the economy, because while the market and the economy don’t move in lockstep, they will follow the same path. We believe the US economy is very strong. Our economic growth is 70% driven by consumers, and another 18% is driven by Government spending.

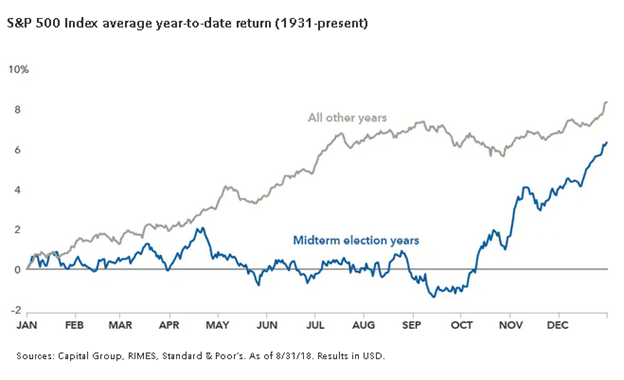

We do believe some version of BBB will pass, if only because the Dems are going to need all the help they can get in the mid-term elections. Speaking of which, here’s another interesting chart that shows since 1931 what the stock market did on average during a mid-term election year (blue line) verse the rest of the years (grey line). It’s interesting to see that historically these years are often weak until the mid-term elections pass, which does align itself with our feelings of how 2022 could go.

No amount of increase in government spending would be enough if consumers decided to reign in their spending. For the US economy to remain strong, and corporate earnings to grow, we need to see a transition from government-led and stimulus-led spending to an economy that can grow on its own, with the consumer playing a pivotal role in the next stage of economic growth. We must be mindful that what consumers say and what they do could be diametrically opposed in 2022. We fully expect consumer surveys to reflect fears of Omicron, inflation, pending mid-term elections, and even Geopolitical fears if this issue in the Ukraine is escalated. While December retail sales stumbled a bit, it is possible consumers listened to the media and purchased many holiday gifts earlier in the year than usual.

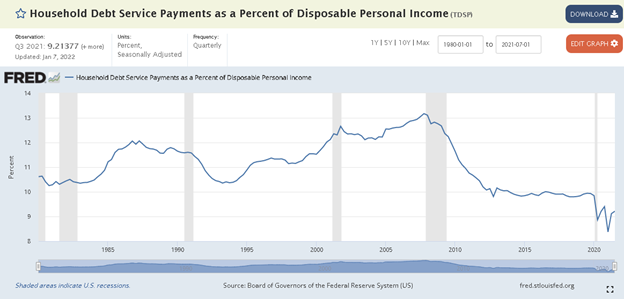

Overall inflation-adjusted retail sales for 2021 saw the highest jump since 1999. Again, this makes sense as demand has not subsided even in the face of higher prices and supply shock issues. Consumers’ net worth has more than doubled from the lows of the Great Financial Crisis in 2009. Meanwhile those with debt have benefited from refinancing at record low rates. This has caused the household debt service ratio, or debt payments as a percentage of disposable income, to hit 40+ year lows as seen below:

Summary

As we think about 2022, we must acknowledge that historically the stock market has been challenged in years when there are mid-term elections, and in years in which the Fed has started to hike interest rates. Both events are going to occur in 2022, and we have no reason to believe the volatility that we’ve seen in the first two weeks won’t persist until both events are in the rear-view mirror. But the economy is strong, consumers’ finances are in the best shape ever and barring a black swan type of event, the economy and S&P earnings should continue to grow in 2022, which should lead to decent gains for the stock market.

Derek Amey serves as Partner and Portfolio Manager at StrategicPoint Investment Advisors in Providence and East Greenwich. You can e-mail him at damey@strategicpoint.com.

The information contained in this post is not intended as investment, tax or legal advice. StrategicPoint Investment Advisors assumes no responsibility for any action or inaction resulting from the contents herein. Derek’s opinions and comments expressed on this site are his own and may not accurately reflect those of the firm. Third party content does not reflect the view of the firm and is not reviewed for completeness or accuracy. It is provided for ease of reference. Certain statements contained herein may be statements of future expectations and other forward-looking statements that are based on SPIA’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. In addition to statements which are forward-looking by reason of context, the words “may, will, should, expects, plans, intends, anticipates, believes, estimates, predicts, potential, or continue” and similar expressions identify forward-looking statements. Forward-looking statements necessarily involve risks and uncertainties, and undue reliance should not be placed on them. There can be no assurance that forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. SPIA assumes no obligation to update any forward-looking information contained herein.