There is no perfect measure to say how the stock market in the US is performing. Every major index you see mentioned on the news has some pros and cons. Typically, every nightly news report will mention the daily returns of the Big 3: the Dow Jones Industrial Average, the NASDAQ and the S&P 500.

The Dow Jones Average is probably the most widely known, but at 30 stocks, most feel it is not diverse enough to summarize the entire US stock market. The NASDAQ is also quite popular, and it does contain over 2,500 stocks. But almost 50% of that index is comprised of technology stocks, so many feel it is not representative of the entire US stock market. The S&P 500 is probably the most diverse amongst industries, and certainly is used most often to describe the US Stock market. Ironically though, the S&P 500 right now has 505 stocks in it right now, because it includes multiple share classes for 5 different companies.

The S&P 500 index is a “market capitalization” weighted index. This means as the total value of all outstanding shares for any company rises and falls, the impact that same company’s stock has on the index also increases and decreases. As such, the largest publicly traded companies in the US have the largest impact on which way the S&P index moves from one minute to the next. The bigger the company, the more that stock will impact the returns of the S&P 500.

For example, Microsoft’s market capitalization is around $1.36 Trillion dollars, while Hasbro’s is “only” $8.8 Billion. So if both Microsoft and Hasbro’s stock prices moved the same exact percentage on any given day (imagine they both rose 2%), Microsoft’s impact on the daily movement of the S&P 500 index would be 154 times larger than Hasbro’s, due to their difference in market capitalization.

The issue with a market-cap weighted index like the S&P 500 is that as certain companies grow larger and larger, they can mask what the returns of the other 499 stocks are doing. In normal markets, a rising S&P 500 index will typically lift stocks and sectors with it, but nothing about the last few months has been normal. Some analysts and investors prefer to use an equal weight S&P 500 index to see how the stock market is doing. An equal weight index is as simple as the name implies: every company’s impact is identical, regardless of a company’s size. Let’s look at how both indices have done this year.

Traditional S&P 500 vs S&P 500 Equal-Weight

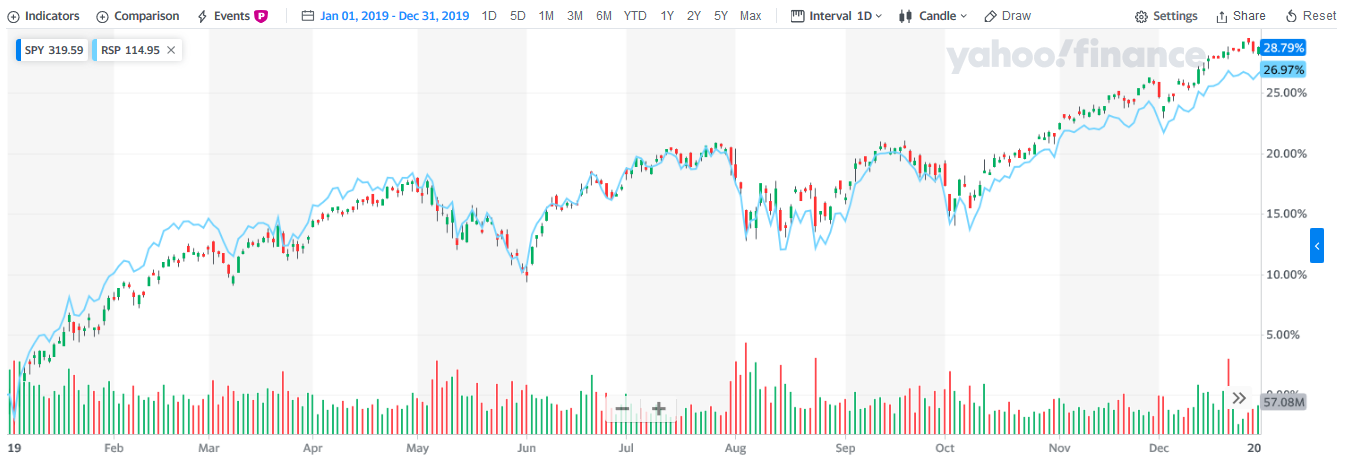

In the two charts below I’m using two ETFs (SPY and RSP) that mimic the returns of the S&P 500 (SPY) and the equal weight S&P 500 (RSP). First let’s look at the returns of each during 2019, which was a strong year for the stock market.

The red and green candlesticks show the path of the traditional S&P 500 ETF (SPY) during 2019, and we can see up in the top corner that by year-end, the SPY ETF was up 28.79%. The light blue line tracks the returns of the equal-weight S&P 500 ETF (RSP) and here we see where that ETF was up 26.97% for the year. So, while there was a slight divergence in returns, it was nothing too dramatic.

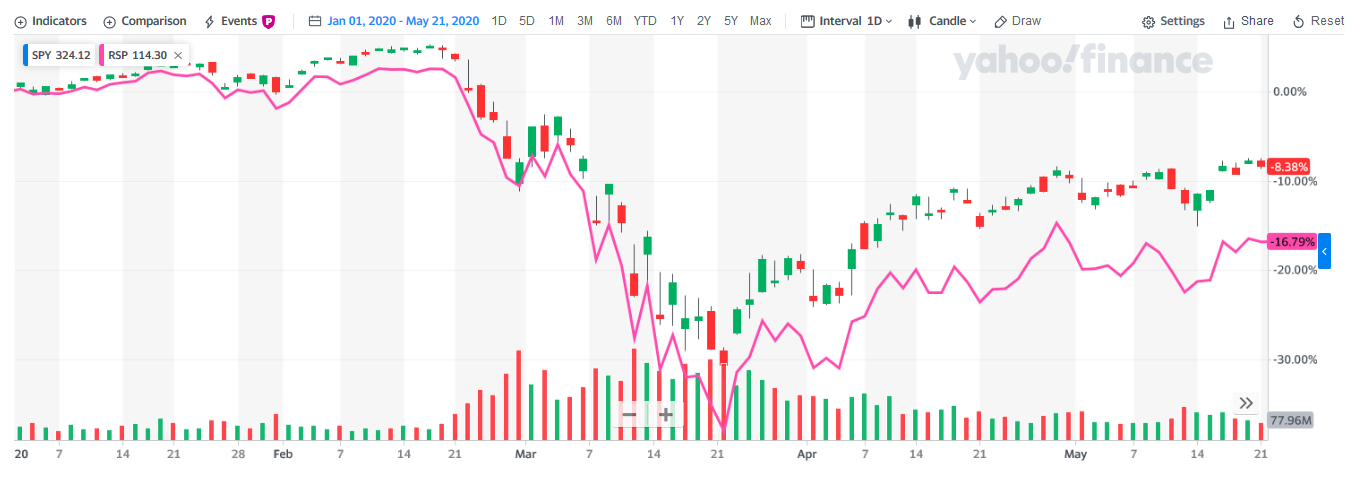

Now let’s look at the same chart but for year-to-date 2020.

As opposed to last year, we suddenly see a massive divergence between the two indices. The SPY ETF is down 8.38% through 5/21 while the equal weight RSP is down almost 17%! The proper way to interpret this is that the traditional S&P 500 with its market-cap weighting is doing ok all things considered. However, since the equal weight index removes the size of any company’s impact on the index, the equal weight return shows us the reality is a lot of stocks are still performing poorly.

What is behind the divergence?

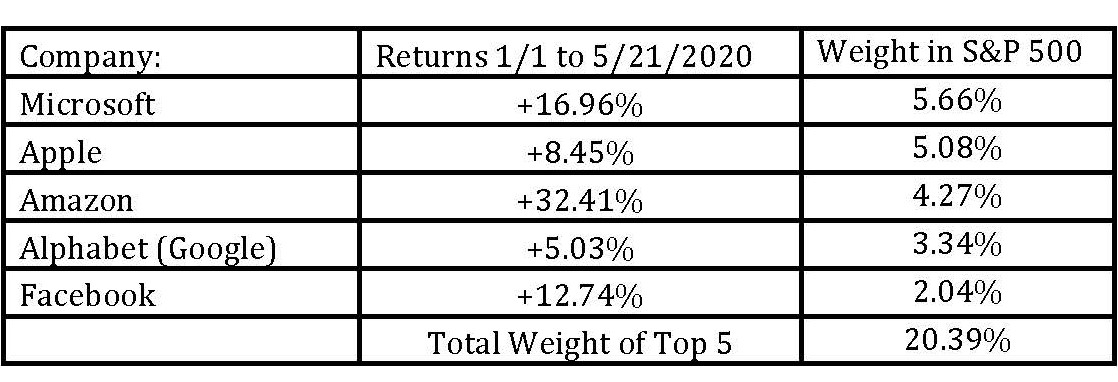

The answer is quite simple, and something that potentially could be an issue going forward. Look below at the top 5 holdings in the index and their year-to-date return and their weights in the traditional S&P 500. We see four massive tech companies, and the one exception is Amazon, although many regard Amazon as a quasi-tech company as their AWS cloud-service made up over 50% of their operating income last year.

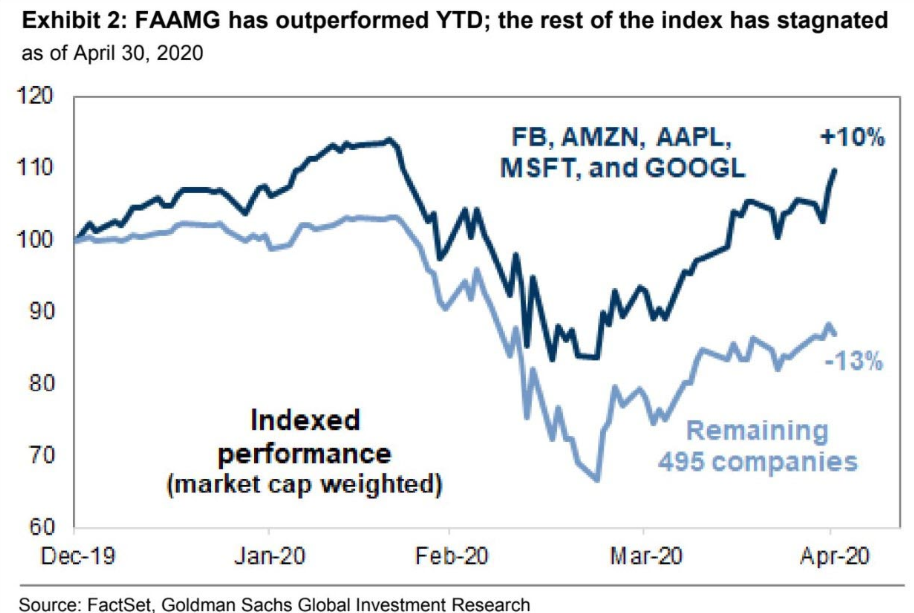

It is amazing that these companies’ stock prices are performing as well as they are in the middle of a global pandemic. The chart below is a little stale as its as of 4/30/2020 but the point is clear: the performance of these 5 companies is VASTLY different than the rest of S&P 500.

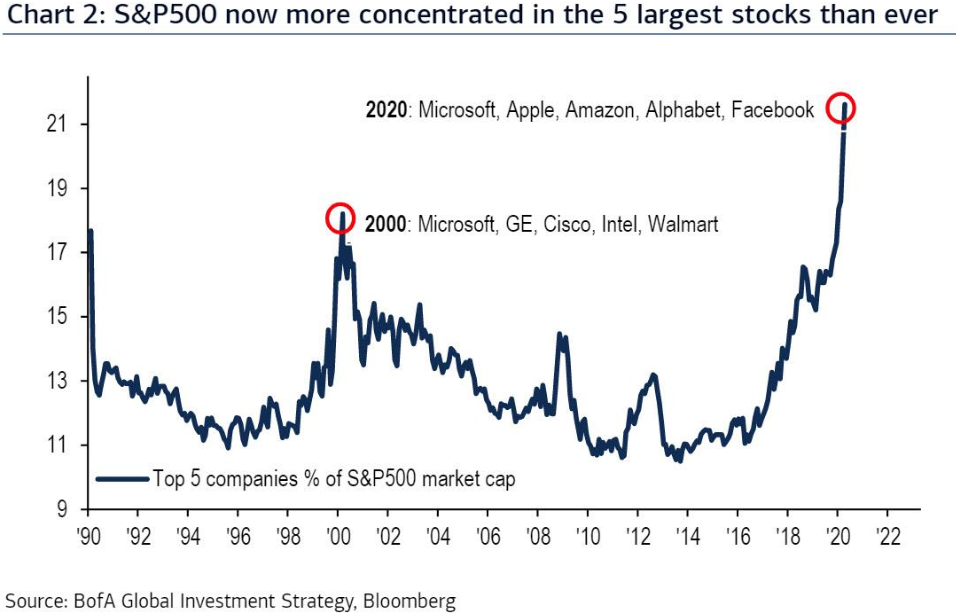

If we look back at the weight of each company in the S&P 500, we see the top 5 companies represent over 20% of the index. This helps explain some of why the traditional S&P 500 is doing considerably better than its equal-weight index. It is also the source of some concern among investors and market analysts, as that narrow leadership is typically not sustainable. Below is a chart going back to 1990 on the X-axis, and the cumulative weight of the top 5 stocks in the S&P for any given year on the Y-axis. For the last 30 years, we’ve never had 5 companies dominate the index to such a degree! In fact, the last time it was at a record high, at least there was a little diversification among the companies at that time (Microsoft, GE, Walmart, Intel, Cisco).

There may be a few reasons why we’re seeing these specific 5 companies dominate the market right now:

- Investors view these business models as winners during the current stay-at-home economy

- Investors (worried about economic growth) are willing to overpay for corporations who are currently growing

- Investors view the balance sheets of these companies as safe in this current economic environment, due to each company’s rather large cash balance

SUMMARY:

- COVID has caused a historical divergence between winners and losers in the stock market

- In the last 30 years, we have never seen the top 5 companies in the S&P 500 represent such a large percentage of the index.

- Currently the largest 5 companies in the S&P 500 are all essentially from the same industry: technology.

- The returns from those 5 companies, while strong, is masking issues for the rest of the US stock market where the average stock is still down quite substantially.

- None of these issues are by themselves are a canary in a coal mine but taken together they are troublesome.

While many of us might like to work for Microsoft, Apple, Amazon, Google or Facebook, the reality is not everyone can work for these 5 companies. While returns of the stock market is being carried by these 5 major tech companies so far in 2020, in our view this isn’t sustainable. If other sectors of the US economy do not pick up soon, even the revenues of these 5 companies may start to suffer. Ultimately this issue will resolve itself in one of two manners (rest of economy picks up OR these companies start to be negatively impacted). It’s too early to know which way it will sort itself out, but it is something many of us will continue to watch!

Derek Amey serves as Partner and Portfolio Manager at StrategicPoint Investment Advisors in Providence and East Greenwich. You can e-mail him at damey@strategicpoint.com.

The information contained in this post is not intended as investment, tax or legal advice. StrategicPoint Investment Advisors assumes no responsibility for any action or inaction resulting from the contents herein. Derek’s opinions and comments expressed on this site are his own and may not accurately reflect those of the firm. Third party content does not reflect the view of the firm and is not reviewed for completeness or accuracy. It is provided for ease of reference. Certain statements contained herein may be statements of future expectations and other forward-looking statements that are based on SPIA’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. In addition to statements which are forward-looking by reason of context, the words “may, will, should, expects, plans, intends, anticipates, believes, estimates, predicts, potential, or continue” and similar expressions identify forward-looking statements. Forward-looking statements necessarily involve risks and uncertainties, and undue reliance should not be placed on them. There can be no assurance that forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. SPIA assumes no obligation to update any forward-looking information contained herein.

*Past performance is not indicative of future results. Indices are unmanaged and you cannot directly invest in them. The Nasdaq Composite Index measures all NASDAQ U.S. and non-U.S. based common stocks listed on the Nasdaq Stock Market. The S&P 500 index is based on the average performance of 500 industrial stocks monitored by Standard and Poor’s. The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The data referred to above was taken from sources believed to be reliable. StrategicPoint Investment Advisors has not verified such data and no representation or warranty, expressed or implied, is made by StrategicPoint Investment Advisors.