As the father of a newborn, saving for college is now a major financial goal for my household. After years of helping clients tackle the following questions, I’m doing it for my own family. There’s a lot to consider including:

- Projecting the potential cost of college education

- Determining how much to save

- Helping to decide where best to invest (529 plan? Custodial account? Account in parents’ name?)

- Guiding how to invest those savings

- Helping choose the right 529 plan

During my discussions with parents about college, one thing that I’ve repeated to anyone who would listen is that unless the laws of “supply and demand” are broken, that high inflation in college tuition is not sustainable. Over the years I’ve had to explain my theory in great detail to convince parents but recently there was an article in the Wall Street Journal which is confirming my belief: finally, the high inflation rates for a college education during the mid-2000’s have fully receded.

(In order to read WSJ articles, one must be a paid subscriber. For those that are here is the link: https://www.wsj.com/articles/in-reversal-colleges-rein-in-tuition-1500822001 For those of you with a print subscription the article can be found in the July 24, 2017 edition titled “Colleges begin reining in tuitions long rise”)

The article states that according to the most current figures from the Labor Department, tuition at college (after scholarships and grants are considered) rose just 1.9% from 2016, in line with overall inflation here in the US. This is a HUGE reversion, and one that parents around the US should be extremely excited about. If this trend continues (as I suspect it will), it will be a reprieve to the many parents juggling saving for retirement and saving for their children’s education. For some historical perspective, during the 2000’s there were a few years where the cost of college was increasing in the high single-digits year over year. Planning out college costs for a newborn during the mid-2000’s, when college costs were increasing at near double-digits was painful. One of the key takeaways from the article is that this trend of lower inflation for the cost of college is not a new phenomenon, and it should continue.

Why?

One of the most fundamental principles of economics is based on supply and demand. If demand for a good or service grows, without a corresponding growth in supply, the price typically will increase. Conversely, if the supply grows and the demand does not, prices should fall. The price we pay for a gallon of gas is the one of the best example of these forces at work. While gasoline prices can ebb and flow from day-to-day, the prices of most goods and services change more slowly reacting to shifting changes in supply and demand over longer periods of time.

Let’s look at the economics of supply/demand for college costs.

Demand

Demographics may be the key factor that drives overall demand for any good or services. In fact, demographics can be used to explain why some countries are growing faster or slower than others. Japan’s economy, for example, has struggled to achieve strong growth recently. Interestingly enough, they sell more adult diapers in Japan than they do baby diapers.

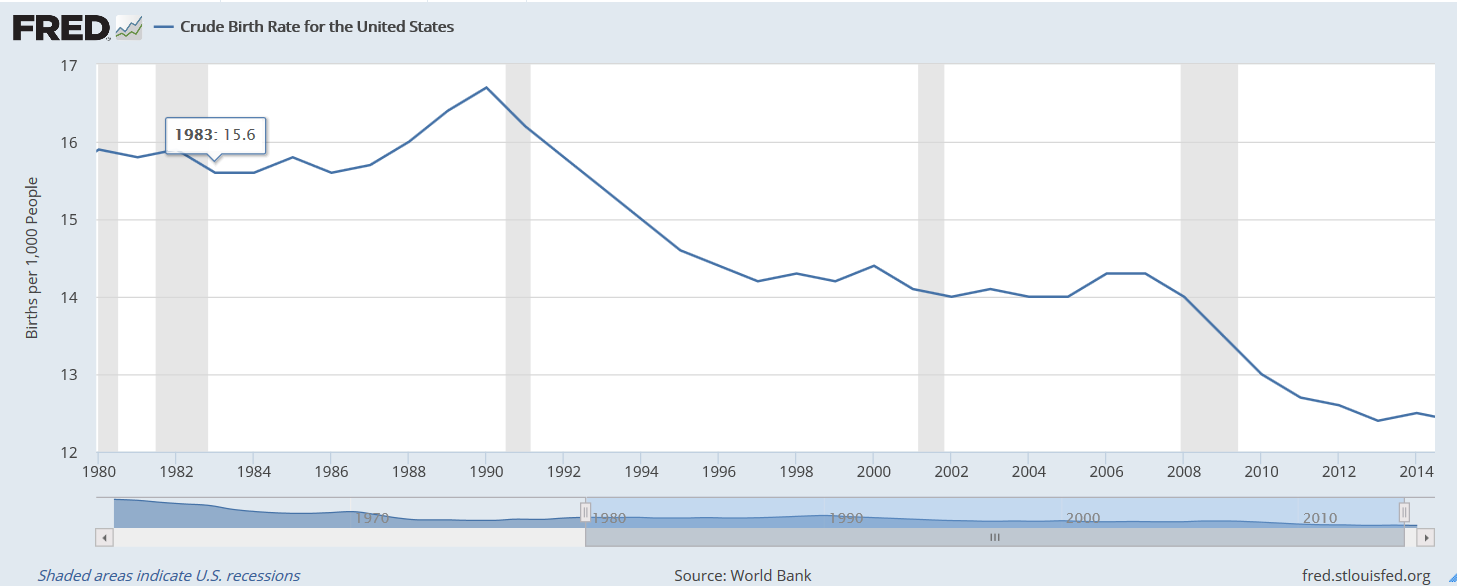

During the past 20 years, there has been a steep climb in the amount of eligible college-aged kids. The combination of a population growth spurt here in the US, higher high school graduation rates than in previous years and increasing draw of international students to colleges here in the US led to massive growth. By some estimates, the total number increased by over 20%. However, college enrollment peaked in 2011. Birth rates are highly to blame, and the forecast for the future doesn’t show a massive reversal. Compared to the 1980’s, every decade has seen a gradually lower birth rate here in the US.

While the number of international kids attending our schools continues to rise, according to current enrollment figures international students only make up around 5% of the total students in college. Unless that number increases dramatically, the clear trend of fewer kids here in the US will mean less demand for a college degree.

Supply

Over the past 20 years, colleges have begun to resemble businesses more than nonprofit schools. With that came a rapid growth in the amount of degree-granting institutions. In the period from 1992 to 2012, we saw the total number of colleges and universities grow by over 30%. (https://nces.ed.gov/programs/digest/d16/tables/dt16_317.10.asp)

This was a very predictable economic reaction. As demand grew, the market reacted by increasing supply. However, as the demand is slowing we’ve yet to see an equivalent reaction in supply.

Economic historians will teach us that quite often supply is slow to react to shrinking demand. While there has been some reduction in total number of degree granting institutions in the past few years, the pullback represents a mere 3%. In addition, these figures do nothing to show what the total amount of kids the remaining schools can handle. As the demographics grew, colleges ramped up their infrastructure in response and many can handle a far greater amount of students than they could 20 years ago.

Conclusion

I’ve purposely avoided debating the merits of a college education and the cost-benefit analysis; we can save that for another day. The reality is that most parents want to see their children have opportunities to succeed and to have a career doing anything they want and many jobs will always require some form of higher education. Thankfully it appears after a decade of massive growth in the cost of sending our little ones to college, the economic realities of supply and demand are providing some relief. While we wish it were otherwise, rest assured this doesn’t mean we can all stop saving for college anytime soon!

Derek Amey serves as Managing Director and Portfolio Manager at StrategicPoint Investment Advisors in Providence and East Greenwich. You can e-mail him at damey@strategicpoint.com.

The information contained in this post is not intended as investment, tax or legal advice. StrategicPoint Investment Advisors assumes no responsibility for any action or inaction resulting from the contents herein. Derek’s opinions and comments expressed on this site are his own and may not accurately reflect those of the firm. Third party content does not reflect the view of the firm and is not reviewed for completeness or accuracy. It is provided for ease of reference.