I’m writing this blog on the first day of Spring, thinking about how different our lives are now from a year ago. I’m painfully aware that many Americans are still struggling due to COVID and our thoughts and prayers go to those folks. At the same time there is some reason to be optimistic as the seasons change. Here in the US we see new COVID cases and hospitalizations falling, and at the same time the percentage of Americans receiving the vaccine continues to trend higher. If these trends continue, we could all be amazed at how much our lives have returned to “normal” by the first day of Summer in June.

For investors, however… especially those who don’t understand “base effects,” there are clouds forming on the horizon even if they don’t see them yet

How inflation is measured

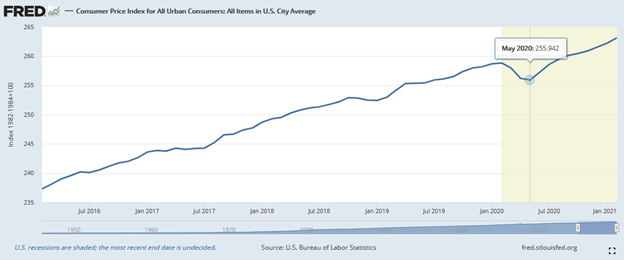

When economists report inflation in the US they compare the inflation level to the same time frame from a year prior and then report it as a percentage change. Below is the chart of the index they use to figure out the year-over-year change in CPI (Consumer Price Index). As you can clearly see, starting in March of last year we started to see the disinflationary effects of COVID. In fact, last year we had three straight months (March, April, May) where we saw the index drop, which means prices overall were dropping. It wasn’t till the June 2020 report where we started to see inflation reports go positive again. That drop we saw last year, for three straight months, is the exact reason we’re all but guaranteed to see a spike in the CPI over the coming months.

Based on where the CPI level is registering right now, even if the month-to-month level did not change, we would still see the year over year figure go from 2% to almost 3%! With the next round of stimulus checks about to arrive, what are the chances we see no inflation over the next few months? Pretty low. (By the way, for more information on the latest stimulus package, read Betsey’s latest blog here.)

Economists have a term for this phenomenon: it is called the “base effect” which is defined as the distortion of the inflation report whenever there is a really low or high previous year report. Looking at the math and playing with some conservative figures, it is not out of the question that we will see CPI register as high as 3.5% by the time the May figures are released in June. The last time the CPI was that high was 2011!

What will the Fed do if they start to see over 3% inflation?

A lot of people expect the Fed to hammer home the “base effect” explanation, and that they will pull out the same exact phrase they used back in 2011. Back then Fed Chair Bernanke kept telling us that the inflation we were seeing was “transitory” and it was not of long-term concern. While there were a few months in 2011 where CPI registered over 3%, Bernanke was ultimately vindicated as inflation sagged into 2012, and has remained muted ever since.

Chairman Jay Powell has been consistent that the Fed will not act to raise rates until they see confirmation that the recovery is well underway, even if inflation is higher than they would like. Remember that when the Fed raises interest rates, with all else equal, they are doing it to try and slow the economy down and curb inflation.

Prior to COVID, part of the dual mandate of the Fed was a “2% inflation target.” However, last year they changed the wording to say they aim to reach an “average of 2% inflation.” While this change in wording may seem like semantics, that could not be further from the truth. Averaging 2% inflation, especially in an economy that has not had sustained 2% inflation in quite some time, is an admittance that they will let inflation run above 2%. How else would one achieve an average of 2% when inflation has been around 1%? Questions remain about how high they would let inflation run, or how long they would let it register above 2% before acting. The next few months could represent the first test of how high they might let inflation go, but it may not test the duration question because by the fall of 2021 the base effects impact on year-over-year inflation will have worn off.

What will bond investors do if they see inflation coming in over 3%?

There’s an old saying on Wall Street, that good investors “buy the rumor, and sell the news.” The implication being that by the time a rumor becomes fact, the market has already discounted that rumor and you should be selling your investment because the big move is over.

US Treasuries are off to their worst performance to start a year in quite some time. At the start of 2021, a 10-year Treasury bond was yielding just 0.91%. Now 10-year Treasuries are yielding 1.66% and that backup in yields has turned into losses. As a reminder, when yields go UP, the prices of existing bonds go down, which is why the bond market has struggled to start the year. Bond investors know about the “base effects” impact on the CPI, and it’s possible that they have been selling bonds in anticipation of pending inflation.

Ultimately the bond market will have to figure out if the Fed is correct in its assessment, that high inflation reports over the next few months are just temporary. If it appears that inflation will not subside, once the “base effects” impact wears off, there could be more pain in the bond market throughout 2021.

Summary

Investors should prepare themselves for the onslaught of those in financial media screaming about how inflation is running amok, and the Fed is woefully behind the curve. Some of the more acerbic commentators might even start predicting hyperinflation. When the Fed refuses to act and continues to say that the inflation is temporary, expect some of these commentators to double down on their calls. It could feel downright scary to many who do not understand how the math works. But unless we see inflation continue to be hot in the Fall, it would be best to categorize the next few months for what it truly is: an increase due to the disinflationary months from last year when COVID first hit the US economy.

Derek Amey serves as Partner and Portfolio Manager at StrategicPoint Investment Advisors in Providence and East Greenwich. You can e-mail him at damey@strategicpoint.com.

The information contained in this post is not intended as investment, tax or legal advice. StrategicPoint Investment Advisors assumes no responsibility for any action or inaction resulting from the contents herein. Derek’s opinions and comments expressed on this site are his own and may not accurately reflect those of the firm. Third party content does not reflect the view of the firm and is not reviewed for completeness or accuracy. It is provided for ease of reference. Certain statements contained herein may be statements of future expectations and other forward-looking statements that are based on SPIA’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. In addition to statements which are forward-looking by reason of context, the words “may, will, should, expects, plans, intends, anticipates, believes, estimates, predicts, potential, or continue” and similar expressions identify forward-looking statements. Forward-looking statements necessarily involve risks and uncertainties, and undue reliance should not be placed on them. There can be no assurance that forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. SPIA assumes no obligation to update any forward-looking information contained herein.